Ansoff’s matrix as a tool for Strategy Definition

Published by Pavel Nakonechnyy on in Business Analysis.Ansoff’s Matrix, also known as the Product/Market Expansion Grid or Ansoff’s Box, is a strategic planning tool that provides a set of strategic alternatives that organisations may consider when defining their business strategy. Developed by Igor Ansoff and first published in the Harvard Business Review in 1957, the matrix provides a framework for executives, senior managers, and marketers to devise strategies for future growth by considering existing and new products in existing and new markets.

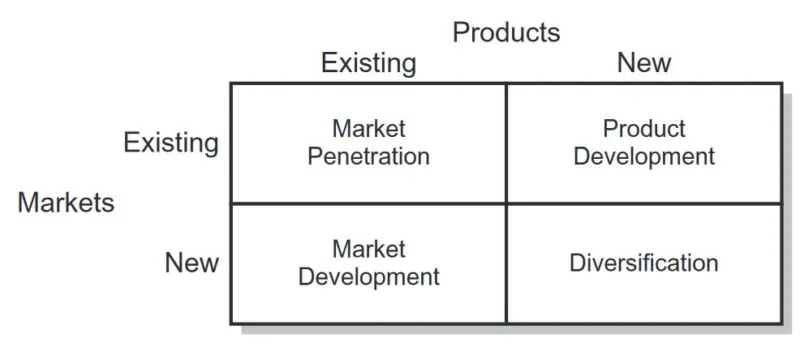

The Ansoff Matrix is a 2×2 grid that categorizes growth strategies into four distinct quadrants: Market Penetration, Market Development, Product Development, and Diversification. Each quadrant represents a different approach to growth, with varying levels of risk and potential reward.

- Market Penetration. Market Penetration involves increasing market share within existing markets using existing products. In this approach, organisations decide to continue with their existing products and markets but to adopt tactics such as additional promotion, increased sales efforts or revised pricing approaches to generate increased market share. This strategy is the least risky as it leverages the company’s capabilities and market knowledge. Examples include growing marketing efforts, enhancing customer loyalty programs, or competitive pricing strategies.

- Market Development. Market Development entails expanding into new markets with existing products. This could involve targeting new customer segments, geographical expansion, or entering new demographic areas. While this strategy carries more risk than market penetration, it does not require significant investment in research and development.

- Product Development. Product Development focuses on creating new products or services targeting existing markets. This strategy aims to meet changing customer needs and preferences by innovating or adding new features to existing products. It involves a higher level of risk due to the investment in product development and the uncertainty of market acceptance.

- Diversification. Diversification is the riskiest strategy, involving the introduction of new products into new markets. This approach requires significant investment in product development and market research, as it ventures into uncharted territories for the business. Diversification can be further categorized into related and unrelated diversification, depending on the synergy with the company’s existing operations.

Practical Examples

Several well-known companies have successfully applied the Ansoff Matrix to their growth strategies:

– Apple: Employed a market development strategy by expanding into China and a product development strategy by introducing new products like the iPhone.

– Amazon: Utilized market and product development strategies to expand its market reach and product offerings.

– P&G: Focused on product development to maintain its competitive edge in the consumer goods market.

– Tesla: Adopted a market development strategy by entering new geographical markets with its existing electric vehicles.

– McDonald’s: Pursued a diversification strategy by introducing new products in new markets.

Advantages of the Ansoff Matrix

- Structured Framework. The Ansoff Matrix provides a clear and structured framework for considering growth options, making it easier for businesses to visualize and discuss potential strategies. This structured approach helps in aligning team members and stakeholders, facilitating better communication and strategic planning.

- Risk Assessment. One of the key benefits of the Ansoff Matrix is its ability to help businesses assess the relative risk associated with each growth strategy. By categorizing strategies based on risk levels, companies can make more informed decisions and develop risk management plans.

- Flexibility and Adaptability. The Ansoff Matrix is a versatile tool that can be adapted to suit the specific needs and goals of a company. It encourages continuous evaluation and refinement of strategies in response to market dynamics, allowing organizations to stay agile and seize new opportunities.

- Long-Term Planning. The matrix is not limited to short-term planning; it also supports long-term strategic goals by aligning growth plans with the company’s objectives. This alignment ensures that the chosen strategies contribute to the sustainable growth and success of the business.

Limitations of the Ansoff Matrix

- Oversimplification. While the Ansoff Matrix provides a straightforward framework, it can sometimes oversimplify complex strategic decisions. It does not account for the competitive environment, market trends, or external factors that could impact the success of the chosen strategies.

- Lack of Detailed Analysis. The matrix does not offer a detailed analysis of the external market environment or competitive landscape. Businesses need to use additional tools, such as SWOT, PESTEL, or Porter’s 5 Forces, to gain a comprehensive understanding of the market and make more robust strategic decisions.

John Dawes names two more logical problems [2]:

A problem with subjectivity. A potential issue with the use of the matrix is the subjectivity involved in determining what constitutes one strategy versus another. Using Ansoff’s example:

- An aircraft manufacturer currently produces planes for commercial aviation, product is an airplane.

- Adapting the companies’ passenger planes to transport cargo was stated as an example of a market development strategy. That is, the altered product was very similar to what the business made, but a new market (a vehicle to transport air cargo rather than people) was found for it.

- However, one could argue that an aviation company would sell its planes to airlines that often offer both passenger flights and airfreight. Then, the client list for the airplane builder’s cargo planes will not differ much. Therefore, the product mission – providing a transport vehicle to commercial airlines – would hardly change at all, but the product itself would be different. So, the example used by Ansoff to illustrate a market development strategy might arguably be classified as a product development strategy if we consider the altered aircraft a new product.

- Alternatively, if we did not classify the altered aircraft as new (since it might only entail internal modifications), then this strategy might even be considered a market penetration strategy, if the major clients offer both passenger transport and airfreight.

A problem with the definition of a new product. If we accept new products can be incrementally new, then the combination of new products and new markets does not necessarily equate to a risky break from the past, as elucidated by Ansoff (1957) and echoed by other authors.

If we reject the notion that new products can be incrementally new, and must be really new (to the firm) then it is very likely that developing or adding such a really new product simultaneously takes the firm into a new market, in which case there is no need for a separate strategy called diversification.

Applying Ansoff’s matrix

After conducting a SWOT analysis, the organization has to identify actions that tackle the issues highlighted in the analysis and establish a path forward. These actions might require a reassessment of the organization’s strategy, and Ansoff’s matrix offers a variety of options to assist in this process. For instance, if a weakness in the organization’s product performance has been identified, two potential options from Ansoff’s matrix could be explored:

- to adopt a market penetration strategy by initiating extensive promotional and sales activity, or

- to adopt a product development strategy by initiating the enhancement of the product portfolio.

Ansoff’s matrix provides a means of identifying and evaluating the strategic options open to the organisation in light of the information presented in the SWOT. Together these techniques can ensure that any strategic analysis is carried out in a formal, informed manner. The assessment of the advantages and disadvantages of the four options presented in Ansoff’s matrix provides a systematic approach to strategy definition. The analyst can be confident that the business strategy that emerges from this work will be based upon firm foundations.

Ansoff’s matrix helps with identifying and assessing the strategic options available to the organization based on the insights gained from the SWOT analysis. When used together, these techniques are highly effective in ensuring that Strategic Analysis is conducted in a structured and informed way. Evaluating the pros and cons of the four options outlined in Ansoff’s matrix offers a methodical approach to defining Strategy. This gives the Analyst confidence that the resulting Business Strategy will be reasonable and solid.

The strategy derived from the options provides information that will help the senior management to develop a new MOST for the organisation:

- the Mission may remain intact,

- the business Objectives might require adjustments,

- the Strategy description will need to be changed, and

- the Tactics necessary for the organisation to meet the objectives and implement the strategy will need to be redefined.

The Ansoff Matrix remains a fundamental tool in strategic planning, offering a clear and structured approach to exploring growth opportunities. Despite its limitations, it provides valuable insights into the risk-reward trade-offs of different growth strategies, helping businesses make informed decisions and align their growth plans with long-term objectives. By combining the Ansoff Matrix with other strategic analysis tools, companies can develop comprehensive and effective growth strategies that drive sustainable success.

References

- Ansoff, H I (1957), “Strategies for diversification”, Harvard Business Review, Sept-Oct, 113-124

- Dawes, John (2018). “The Ansoff matrix: a legendary tool, but with two logical problems”.