What is a Relative Market Share (RMS)

Published by Pavel Nakonechnyy on (updated: ) in Business Analysis.

Relative market share is a metric that helps companies identify their position in the market compared to their leading competitor.

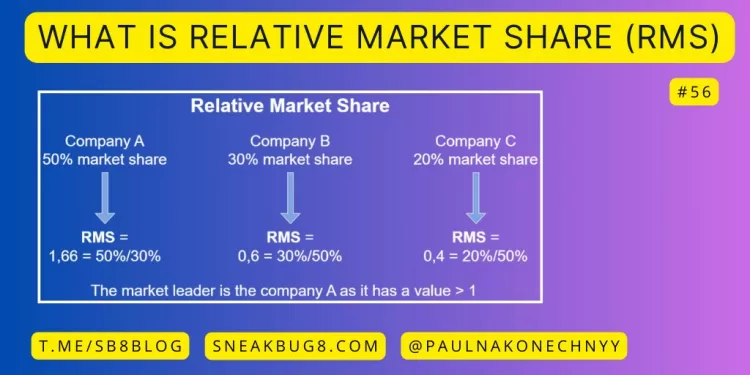

Relative market share is calculated by dividing the market share of the company under consideration by the market share of its strongest competitor. Relative market share can also be calculated by comparing a company’s sales revenue against its largest competitor’s sales revenue. When calculating relative market share for the market leader itself, it is compared to its largest competitor.

Relative market share is important, because it represents the company’s conditions against its competitors better than absolute market share. Airbus and Boeing having both 50% absolute market share face much higher threat from competition than, for example, McDonalds and Burger King with 10% and 2% market share respectively.

Calculating relative market enables managers to compare relative market positions across different product markets. This metric is crucial for making strategic decisions as it highlights the products that need attention and gaps that need bridging, which can help them formulate better strategies for the future.

Another reason for importance of the relative market share is the experience curve. The experience curve means that whenever the cumulative quantity doubles, unit costs fall by 20% to 30%. With McDonalds having 5x Market Share compared to its closest competitor, it has much lower unit costs and higher profit margins.

To summarize, a high market share does not guarantee a comfortable market situation as we have seen in the example of Airbus and Boeing. What is decisive is the relative market share. If it is high, especially if it higher than 1 for market leaders, then this company benefits more from the experience curve than its competitors.